Redefining global finance.

Connecting real world assets

through tokenisation.

Redefining global finance.

Connecting real world assets

through tokenisation.

The next generation marketplace for real-world assets, seamless, secure, and accessible to all.

Redefining global finance.

Connecting real world assets

through tokenisation.

The next generation marketplace for real-world assets, seamless, secure, and accessible to all.

Your gateway to the world’s tokenised economy.

Real investments, real returns, made simple.

Your gateway to the world’s tokenised economy.

Real investments, real returns, made simple.

Your gateway to the world’s tokenised economy.

Real investments, real returns, made simple.

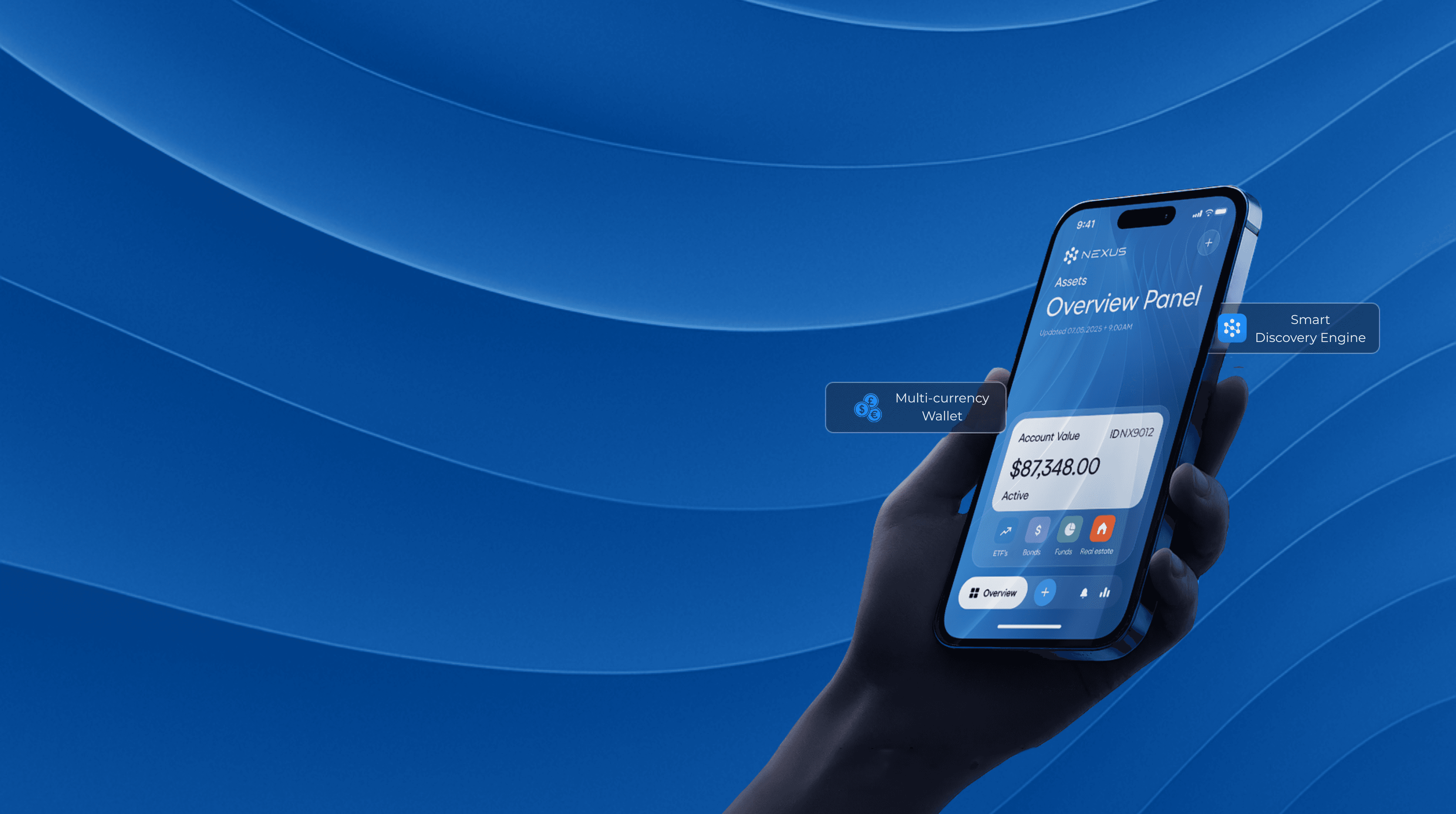

Build a smarter portfolio powered by real assets.

One app. Infinite opportunities.

Build a smarter portfolio powered by real assets.

One app. Infinite opportunities.

Build a smarter portfolio powered by real assets.

One app. Infinite opportunities.

Tokenisation solutions for private and institutional clients

Access bespoke tokenisation services designed for those who value transparency, innovation, and opportunity across every asset class.

Private Clients

Unlock global access to tokenised investments across real estate, private credit, and alternative assets from institutional portfolios to fractional ownership opportunities.

Nexus provides tailored onboarding, and a secure, regulated framework enabling both high-net-worth and private investors to participate in markets once reserved for institutions.

Corporate & Institutional Clients

Build and manage your digital asset treasury through regulated tokenisation.

Nexus Corporate offers institutional-grade custody, direct lending solutions, and access to secondary liquidity, empowering businesses to diversify, raise capital, and scale globally.

Corporate & Institutional Clients

Build and manage your digital asset treasury through regulated tokenisation.

Nexus Corporate offers institutional-grade custody, direct lending solutions, and access to secondary liquidity, empowering businesses to diversify, raise capital, and scale globally.

Tokenisation solutions for private and institutional clients

Access bespoke tokenisation services designed for those who value transparency, innovation, and opportunity across every asset class.

Private Clients

Unlock global access to tokenised investments across real estate, private credit, and alternative assets from institutional portfolios to fractional ownership opportunities.

Nexus provides tailored onboarding, and a secure, regulated framework enabling both high-net-worth and private investors to participate in markets once reserved for institutions.

Corporate & Institutional Clients

Build and manage your digital asset treasury through regulated tokenisation.

Nexus Corporate offers institutional-grade custody, direct lending solutions, and access to secondary liquidity, empowering businesses to diversify, raise capital, and scale globally.

Corporate & Institutional Clients

Build and manage your digital asset treasury through regulated tokenisation.

Nexus Corporate offers institutional-grade custody, direct lending solutions, and access to secondary liquidity, empowering businesses to diversify, raise capital, and scale globally.

Access global assets effortlessly.

Access global assets effortlessly.

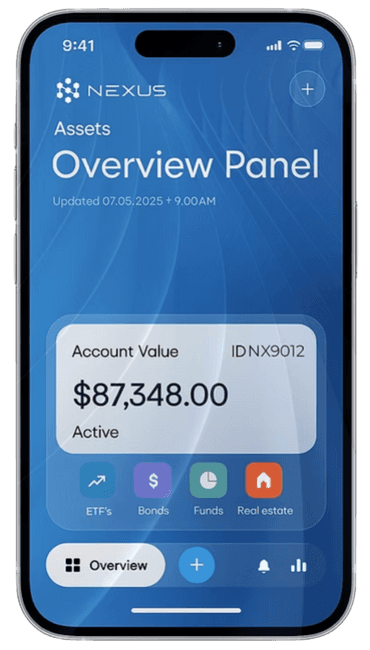

Discover, fund, and manage investments across every major asset class, all within one seamless interface. Nexus connects you to the world’s leading tokenisation platforms through a single, secure account.

Discover, fund, and manage investments across every major asset class, all within one seamless interface. Nexus connects you to the world’s leading tokenisation platforms through a single, secure account.

Global access to real-world assets

Global access to real-world assets

From real estate and private credit to commodities, funds, and alternatives, explore tokenised opportunities across continents in just a few clicks.

Seamless integration with leading partners

Seamless integration with leading partners

Invest directly through regulated tokenisation platforms all aggregated under one global marketplace.

Instant onboarding and funding

Instant onboarding and funding

Verify your identity, open your wallet, and fund instantly in your preferred currency. Nexus automatically routes transactions through trusted custodians for maximum security and simplicity.

Transparent performance tracking

Transparent performance tracking

Monitor every asset’s yield, performance, and on-chain proof in real time. The complexity of blockchain stays hidden, the simplicity of investing remains front and centre.

A Simple Approach to Tokenised

Assets Across Multiple Blockchains

A Simple Approach to Tokenised Assets Across Multiple Blockchains

Nexus offers a simple, intuitive way to access tokenised assets,

no blockchain expertise required, just seamless investing for everyone.

A Simple Approach to Tokenised

Assets Across Multiple Blockchains

A Simple Approach to Tokenised Assets Across Multiple Blockchains

Nexus offers a simple, intuitive way to access tokenised assets, no blockchain expertise required, just seamless investing for everyone.

Why Choose Nexus?

In a world where trillions in real-world assets are moving on-chain, Nexus stands apart as the global marketplace and distribution layer connecting every layer of tokenisation, from asset originators to investors, from liquidity providers to retail access.

The First Truly Unified Marketplace

Nexus aggregates tokenised assets from the world’s leading platforms and brings them together under one seamless interface.

Instead of a fragmented world of isolated ecosystems, Nexus provides the bridge.

One login. One wallet. Every asset class.

Compliance and Transparency by Design

Nexus works within the frameworks of its partners’ regulated infrastructures, using custodial wallets, SumSub for KYC/AML, and Chainlink for proof-of-reserve and price feeds.

Every transaction is secure, every asset verified, and every investor fully compliant.

This ensures trust from day one.

Institutional Trust, Retail Simplicity

Built for family offices, institutional investors, and retail clients alike, Nexus abstracts the complexity of blockchain and presents assets in familiar, fiat-based terms.

Users see performance, liquidity, and valuations in their native currency — while blockchain verification and settlement occur silently in the background.

It’s finance made simple, not technical.

Network Effects and Scalability

Each new partner that joins Nexus, a tokenisation factory, liquidity protocol, or institutional issuer, instantly gains access to the others.

As this network grows, the value of Nexus compounds exponentially, positioning it as the universal gateway for tokenised assets worldwide.

Access to Global Liquidity

Through integrated partnerships with Maple, Aave, and other DeFi protocols, Nexus transforms tokenised assets into living, liquid instruments.

Asset holders can borrow against their portfolios, investors can access secured yields, and liquidity providers gain direct exposure to verified, real-world collateral, all routed through Nexus’ ecosystem.

Vision: The New Terminal for Tokenisation

Nexus isn’t just a marketplace; it’s the foundation of a new financial era.

It is building the infrastructure where every property, bond, fund, and private-credit instrument will exist as a transparent, tradeable, and borderless digital asset.

The future of finance isn’t fragmented — it’s connected. And Nexus is the connection point.

The First Truly Unified Marketplace

Nexus aggregates tokenised assets from the world’s leading platforms and brings them together under one seamless interface.

Instead of a fragmented world of isolated ecosystems, Nexus provides the bridge.

One login. One wallet. Every asset class.

Institutional Trust, Retail Simplicity

Built for family offices, institutional investors, and retail clients alike, Nexus abstracts the complexity of blockchain and presents assets in familiar, fiat-based terms.

Users see performance, liquidity, and valuations in their native currency — while blockchain verification and settlement occur silently in the background.

It’s finance made simple, not technical.

Access to Global Liquidity

Through integrated partnerships with Maple, Aave, and other DeFi protocols, Nexus transforms tokenised assets into living, liquid instruments.

Asset holders can borrow against their portfolios, investors can access secured yields, and liquidity providers gain direct exposure to verified, real-world collateral, all routed through Nexus’ ecosystem.

Compliance and Transparency by Design

Nexus works within the frameworks of its partners’ regulated infrastructures, using custodial wallets, SumSub for KYC/AML, and Chainlink for proof-of-reserve and price feeds.

Every transaction is secure, every asset verified, and every investor fully compliant.

This ensures trust from day one.

Network Effects and Scalability

Each new partner that joins Nexus, a tokenisation factory, liquidity protocol, or institutional issuer, instantly gains access to the others.

As this network grows, the value of Nexus compounds exponentially, positioning it as the universal gateway for tokenised assets worldwide.

Vision: The New Terminal for Tokenisation

Nexus isn’t just a marketplace; it’s the foundation of a new financial era.

It is building the infrastructure where every property, bond, fund, and private-credit instrument will exist as a transparent, tradeable, and borderless digital asset.

The future of finance isn’t fragmented — it’s connected. And Nexus is the connection point.

The First Truly Unified Marketplace

Nexus aggregates tokenised assets from the world’s leading platforms and brings them together under one seamless interface.

Instead of a fragmented world of isolated ecosystems, Nexus provides the bridge.

One login. One wallet. Every asset class.

Compliance and Transparency by Design

Nexus works within the frameworks of its partners’ regulated infrastructures, using custodial wallets, SumSub for KYC/AML, and Chainlink for proof-of-reserve and price feeds.

Every transaction is secure, every asset verified, and every investor fully compliant.

This ensures trust from day one.

Institutional Trust, Retail Simplicity

Built for family offices, institutional investors, and retail clients alike, Nexus abstracts the complexity of blockchain and presents assets in familiar, fiat-based terms.

Users see performance, liquidity, and valuations in their native currency — while blockchain verification and settlement occur silently in the background.

It’s finance made simple, not technical.

Network Effects and Scalability

Each new partner that joins Nexus, a tokenisation factory, liquidity protocol, or institutional issuer, instantly gains access to the others.

As this network grows, the value of Nexus compounds exponentially, positioning it as the universal gateway for tokenised assets worldwide.

Access to Global Liquidity

Through integrated partnerships with Maple, Aave, and other DeFi protocols, Nexus transforms tokenised assets into living, liquid instruments.

Asset holders can borrow against their portfolios, investors can access secured yields, and liquidity providers gain direct exposure to verified, real-world collateral, all routed through Nexus’ ecosystem.

Vision: The New Terminal for Tokenisation

Nexus isn’t just a marketplace; it’s the foundation of a new financial era.

It is building the infrastructure where every property, bond, fund, and private-credit instrument will exist as a transparent, tradeable, and borderless digital asset.

The future of finance isn’t fragmented — it’s connected. And Nexus is the connection point.

Nexus empowers you to manage, move, and monitor your assets with absolute confidence, in one intelligent, unified platform designed for the future of finance.

Nexus empowers you to manage, move, and monitor your assets with absolute confidence, in one intelligent, unified platform designed for the future of finance.

A few things you may want to ask us

A few things you

may want to ask us

What is Nexus?

Nexus is the world’s first unified marketplace for tokenised real-world assets (RWAs). It aggregates verified tokenisation platforms into one seamless interface, allowing users to access, trade, and manage assets globally across multiple blockchains through a single account and wallet.

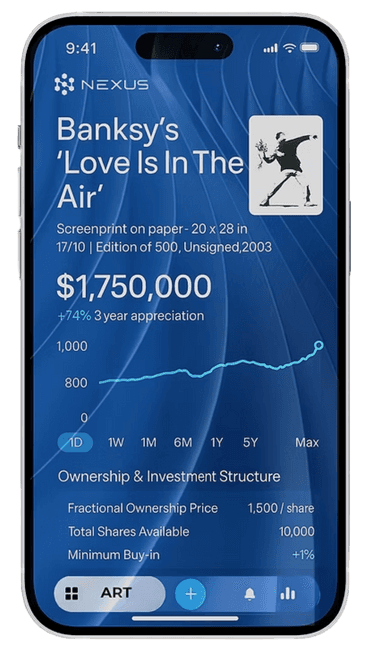

What types of assets can be accessed through Nexus?

Nexus supports a wide range of tokenised real-world assets, including: Real estate (residential, commercial, development) Private credit and loans Funds and bonds Infrastructure and commodities Art, collectibles, and alternative investments As the network grows, additional asset classes will continuously be added through Nexus’ verified partners.

Do users need blockchain experience to use Nexus?

No. Nexus is designed for both institutional and retail clients. The blockchain layer operates invisibly in the background, while users see their holdings, performance, and valuations displayed in fiat currency (USD, GBP, EUR, AED, etc.). It feels like a modern financial app, with blockchain security under the hood.

How is Nexus regulated?

Nexus operates within its partners’ regulated frameworks: Fireblocks for custodial wallets and secure transaction execution SumSub for KYC/AML onboarding Chainlink Proof-of-Reserve for price feeds and asset verification Regulated partners Issue the assets themselves under local frameworks (EU, US, or GCC). As Nexus expands, regional regulatory licences will be added (Europe, UK, US, UAE & Asia).

How does Nexus ensure investor protection?

All assets listed on Nexus are: Tokenised by verified, regulated partners Backed by on-chain proof-of-ownership and legal documentation Stored via institutional-grade custody infrastructure Audited and reconciled daily across all connected platforms This provides full transparency and traceability for every investment.

Can asset owners raise liquidity through Nexus?

Yes. Asset owners can borrow against their tokenised assets through integrated DeFi liquidity providers. These borrowing transactions are executed via over-collateralised smart contracts, providing liquidity to verified borrowers while giving lenders yield exposure to real-world collateral.

What makes Nexus different from other platforms?

It’s not a single factory - it’s a global aggregator of all tokenisation factories. It connects the entire ecosystem - tokenisation platforms, liquidity providers, family offices, and investors, under one roof. It aims to become the New Terminal of Tokenisation - the trusted global gateway for digital assets and institutional liquidity.

How large is the market opportunity?

According to Boston Consulting Group, over $16 trillion in real-world assets are expected to be tokenised by 2030. By aggregating supply and enabling secondary liquidity, Nexus is positioned to capture a multi-billion-dollar opportunity within the next 5 years.

What is Nexus?

Nexus is the world’s first unified marketplace for tokenised real-world assets (RWAs). It aggregates verified tokenisation platforms into one seamless interface, allowing users to access, trade, and manage assets globally across multiple blockchains through a single account and wallet.

What types of assets can be accessed through Nexus?

Nexus supports a wide range of tokenised real-world assets, including: Real estate (residential, commercial, development) Private credit and loans Funds and bonds Infrastructure and commodities Art, collectibles, and alternative investments As the network grows, additional asset classes will continuously be added through Nexus’ verified partners.

Do users need blockchain experience to use Nexus?

No. Nexus is designed for both institutional and retail clients. The blockchain layer operates invisibly in the background, while users see their holdings, performance, and valuations displayed in fiat currency (USD, GBP, EUR, AED, etc.). It feels like a modern financial app, with blockchain security under the hood.

How is Nexus regulated?

Nexus operates within its partners’ regulated frameworks: Fireblocks for custodial wallets and secure transaction execution SumSub for KYC/AML onboarding Chainlink Proof-of-Reserve for price feeds and asset verification Regulated partners Issue the assets themselves under local frameworks (EU, US, or GCC). As Nexus expands, regional regulatory licences will be added (Europe, UK, US, UAE & Asia).

How does Nexus ensure investor protection?

All assets listed on Nexus are: Tokenised by verified, regulated partners Backed by on-chain proof-of-ownership and legal documentation Stored via institutional-grade custody infrastructure Audited and reconciled daily across all connected platforms This provides full transparency and traceability for every investment.

Can asset owners raise liquidity through Nexus?

Yes. Asset owners can borrow against their tokenised assets through integrated DeFi liquidity providers. These borrowing transactions are executed via over-collateralised smart contracts, providing liquidity to verified borrowers while giving lenders yield exposure to real-world collateral.

What makes Nexus different from other platforms?

It’s not a single factory - it’s a global aggregator of all tokenisation factories. It connects the entire ecosystem - tokenisation platforms, liquidity providers, family offices, and investors, under one roof. It aims to become the New Terminal of Tokenisation - the trusted global gateway for digital assets and institutional liquidity.

How large is the market opportunity?

According to Boston Consulting Group, over $16 trillion in real-world assets are expected to be tokenised by 2030. By aggregating supply and enabling secondary liquidity, Nexus is positioned to capture a multi-billion-dollar opportunity within the next 5 years.

What is Nexus?

Nexus is the world’s first unified marketplace for tokenised real-world assets (RWAs). It aggregates verified tokenisation platforms into one seamless interface, allowing users to access, trade, and manage assets globally across multiple blockchains through a single account and wallet.

What types of assets can be accessed through Nexus?

Nexus supports a wide range of tokenised real-world assets, including: Real estate (residential, commercial, development) Private credit and loans Funds and bonds Infrastructure and commodities Art, collectibles, and alternative investments As the network grows, additional asset classes will continuously be added through Nexus’ verified partners.

Do users need blockchain experience to use Nexus?

No. Nexus is designed for both institutional and retail clients. The blockchain layer operates invisibly in the background, while users see their holdings, performance, and valuations displayed in fiat currency (USD, GBP, EUR, AED, etc.). It feels like a modern financial app, with blockchain security under the hood.

How is Nexus regulated?

Nexus operates within its partners’ regulated frameworks: Fireblocks for custodial wallets and secure transaction execution SumSub for KYC/AML onboarding Chainlink Proof-of-Reserve for price feeds and asset verification Regulated partners Issue the assets themselves under local frameworks (EU, US, or GCC). As Nexus expands, regional regulatory licences will be added (Europe, UK, US, UAE & Asia).

How does Nexus ensure investor protection?

All assets listed on Nexus are: Tokenised by verified, regulated partners Backed by on-chain proof-of-ownership and legal documentation Stored via institutional-grade custody infrastructure Audited and reconciled daily across all connected platforms This provides full transparency and traceability for every investment.

Can asset owners raise liquidity through Nexus?

Yes. Asset owners can borrow against their tokenised assets through integrated DeFi liquidity providers. These borrowing transactions are executed via over-collateralised smart contracts, providing liquidity to verified borrowers while giving lenders yield exposure to real-world collateral.

What makes Nexus different from other platforms?

It’s not a single factory - it’s a global aggregator of all tokenisation factories. It connects the entire ecosystem - tokenisation platforms, liquidity providers, family offices, and investors, under one roof. It aims to become the New Terminal of Tokenisation - the trusted global gateway for digital assets and institutional liquidity.

How large is the market opportunity?

According to Boston Consulting Group, over $16 trillion in real-world assets are expected to be tokenised by 2030. By aggregating supply and enabling secondary liquidity, Nexus is positioned to capture a multi-billion-dollar opportunity within the next 5 years.